Parlays are a form of wager that combines multiple wagers into one. The winnings from each parlay are rolled over to the next leg if one leg wins. The wager is deemed a winner if all of the legs win. For example, the Super Bowl parlay had the Kansas City Chiefs (-3 against the spread) and the Tampa Bay Buccaneers (-5 against the spread).

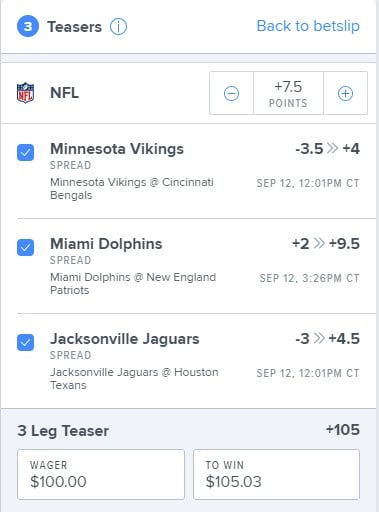

Teasers can increase your chances for winning

You may have heard that teasers can help increase your chances of winning a parlay. Teasers can be placed on multiple teams and used in a parlay. You can increase your chances of winning by lower odds for the team you are betting on.

When placing teasers, the most important thing is to keep the games under ten. It's tempting to place a Teaser on a six-team spread. But the odds of winning aren’t in your favor. It is better to choose two or more selections in order to maximize your chances at winning a parlay. Also, research is key before you place your teasers.

The 'Progressive bets' give you a chance at winning a bet

If you are looking to win big at the casino, you can try progressive bets. These games are high-stakes and exciting. These progressive bets are available at FanDuel Casino and are risk-free for your first day.

Progressive bets have their disadvantages. First, you may run out of money while playing the game. If you lose, you might not be allowed to double your bet. You should know the rules for a progressive wager before placing a bet.

Future bets let you bet on games that are already in progress

Future bets are an excellent way to make money off games that have already begun. These bets can either be placed on single games or on entire tournaments. Bet on your favorite team or single game to get transparent payouts. These payouts can change depending on recent play or news.

Future bets make it easy to understand and they are popular. They offer the opportunity to wager on upcoming events such as league titles or championships. These bets offer the opportunity to place fun wagers on future events, such as league titles, championships and awards.

'Future' bets give you a chance to win a bet

Future bets are a great way for you to make more money if you like betting on sports. These bets can give you the chance of winning a bet on a certain outcome. This kind of betting is popular among recreational gamblers who place bets on teams they like. Professional gamblers rarely bet on the futures markets. Future bets in Las Vegas have high margins, but online they are less profitable. Even if you make a long bet, it is possible to lose large sums of money.

Future bets can also be called prop bets as they offer you a chance of winning a particular bet that is based on an upcoming event. If you place a wager on the Toronto Maple Leafs winning the NFC West division, for example, you will receive +300 odds. You can also bet on the team winning the playoffs or winning more than 10 games during a season. Future bets might be live up to several months ahead of the event depending on which event they are. Futures bets can still be placed, but they are not as popular as other bets. Therefore, you need patience.

Live betting allows you to place bets on current games

Live betting can be a great way to wager on a particular game while it's happening. This is a popular way to bet on NFL games live. It is possible to make bets during the game by simply checking the sportsbooks for new points spreads, moneylines, or totals. You can also make live wagers during scheduled breaks.

Live betting is a popular option in baseball and other sporting events. You can place your bets while the action is still taking place. The sportsbook will adjust the odds as the game progresses, so it is important to watch closely for any changes. Before placing your wager, it is a good idea to review the scores and the lineup.

FAQ

What is personal financial planning?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You're free from worrying about paying rent, utilities, and other bills every month.

And learning how to manage your money doesn't just help you get ahead. It can make you happier. When you feel good about your finances, you tend to be less stressed, get promoted faster, and enjoy life more.

So who cares about personal finance? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

Today, people use their smartphones to track budgets, compare prices, and build wealth. You can find blogs about investing here, as well as videos and podcasts about personal finance.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. This leaves just two hours per day for all other important activities.

Personal finance is something you can master.

What is the distinction between passive income, and active income.

Passive income is when you make money without having to do any work. Active income requires effort and hard work.

Active income is when you create value for someone else. You earn money when you offer a product or service that someone needs. This could include selling products online or creating ebooks.

Passive income can be a great option because you can put your efforts into more important things and still make money. However, most people don't like working for themselves. So they choose to invest time and energy into earning passive income.

Passive income doesn't last forever, which is the problem. If you wait too long to generate passive income, you might run out of money.

Also, you could burn out if passive income is not generated in a timely manner. It is best to get started right away. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types or passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

Which passive income is easiest?

There are many options for making money online. Many of these methods require more work and time than you might be able to spare. How can you make extra cash easily?

Finding something you love is the key to success, be it writing, selling, marketing or designing. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing. You can find plenty of resources online to help you start. Here's a list with 101 tips and resources for affiliate marketing.

You could also consider starting a blog as another form of passive income. Again, you will need to find a topic which you love teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

There are many ways to make money online, but the best ones are usually the simplest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

How much debt are you allowed to take on?

It is important to remember that too much money can be dangerous. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. If you are running out of funds, cut back on your spending.

But how much should you live with? There is no universal number. However, the rule of thumb is that you should live within 10%. That way, you won't go broke even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You shouldn't spend more that $2,000 monthly if your income is $20,000 For $50,000 you can spend no more than $5,000 each month.

It's important to pay off any debts as soon and as quickly as you can. This includes credit card bills, student loans, car payments, etc. Once these are paid off, you'll still have some money left to save.

You should consider where you plan to put your excess income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

Consider, for example: $100 per week is a savings goal. Over five years, that would add up to $500. You'd have $1,000 saved by the end of six year. In eight years, your savings would be close to $3,000 By the time you reach ten years, you'd have nearly $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. Now that's quite impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. Otherwise, you might wind up with far more money than you planned.

How to create a passive income stream

To make consistent earnings from one source you must first understand why people purchase what they do.

It means listening to their needs and desires. You must learn how to connect with people and sell to them.

You must then figure out how you can convert leads into customers. The final step is to master customer service in order to keep happy clients.

This is something you may not realize, but every product or service needs a buyer. You can even design your entire business around that buyer if you know what they are.

To become a millionaire takes hard work. It takes even more work to become a billionaire. Why? Why?

You can then become a millionaire. And finally, you have to become a billionaire. The same applies to becoming a millionaire.

So how does someone become a billionaire? Well, it starts with being a thousandaire. You only need to begin making money in order to reach this goal.

But before you can begin earning money, you have to get started. So let's talk about how to get started.

What is the fastest way to make money on a side hustle?

If you want to make money quickly, it's not enough to create a product or a service that solves an individual's problem.

It is also important to establish yourself as an authority in the niches you choose. This means that you need to build a reputation both online and offline.

The best way to build a reputation is to help others solve problems. So you need to ask yourself how you can contribute value to the community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are many ways to make money online.

But when you look closely, you can see two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has pros and cons. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. These gigs can be very competitive.

Consulting helps you grow your company without worrying about shipping goods or providing service. However, it can take longer to be recognized as an expert in your area.

In order to succeed at either option, you need to learn how to identify the right clientele. It will take some trial-and-error. But, in the end, it pays big.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money from Home

There's always room to improve, no matter how much you make online. Even the most successful entrepreneurs have to work hard to grow their businesses, and increase their profits.

It's easy to get lost in a rut when you start a business. Instead of focusing on growing your company, you can focus only on increasing revenue. It could lead to you spending more time on marketing and less on product development. You may even forget about customer service.

It is important to evaluate your progress periodically and ask yourself if you are improving or maintaining your status quo. If you're ready to boost your income, consider these five ways.

Productivity doesn't only revolve around the output. You also have to be able to accomplish tasks effectively. So figure out which parts of your job require the most effort and energy, and delegate those jobs to someone else.

For example, if you're an eCommerce entrepreneur, you could hire virtual assistants to handle social media, email management, and customer support.

A team member could be assigned to create blog posts, and another person to manage your lead generation campaigns. If you are delegating, make sure to choose people who will help your achieve your goals more quickly and better.

-

Focus on sales instead of marketing

Marketing doesn't mean spending a lot. Some of the greatest marketers are not paid employees. They are self-employed consultants, who make commissions on the sale of their services.

Instead of advertising product on print ads, TV and radio, try affiliate programs. You can promote products and services from other businesses. For sales to be generated, you don’t need to buy expensive inventory.

-

Hire An Expert To Do What You Can't

Freelancers can be hired to fill in the gaps if you don't have enough expertise. You could hire a freelance graphic designer to create graphics for your website if you aren't familiar with graphic design.

-

Get Paid Faster By Using Invoice Apps

Invoicing is a time-consuming task for contractors. It can be tedious when you have many clients, each wanting different things.

Apps like Xero or FreshBooks make it easy to invoice customers. All your client information can be entered once and invoices sent directly from the app.

-

Promote More Products with Affiliate Programs

Affiliate programs are great because you can sell products without stock. It's also easy to ship products. It's easy to set up a link from your website to the vendor's. Once someone purchases from the vendor's site, they will pay you a commission. Affiliate programs are a great way to build your brand and make more money. If you can provide high-quality content and services, you will attract your audience.