There are many other options for betting on soccer. You can place your bets on the Over or Under totals as well as the Handicap, Point spread, and 3-Way Moneyline. This article will provide more information regarding soccer betting. It covers the basics of these types of betting. You can use this information to help you make the right choice and place a wager on your favorite team.

Total soccer goals over or under

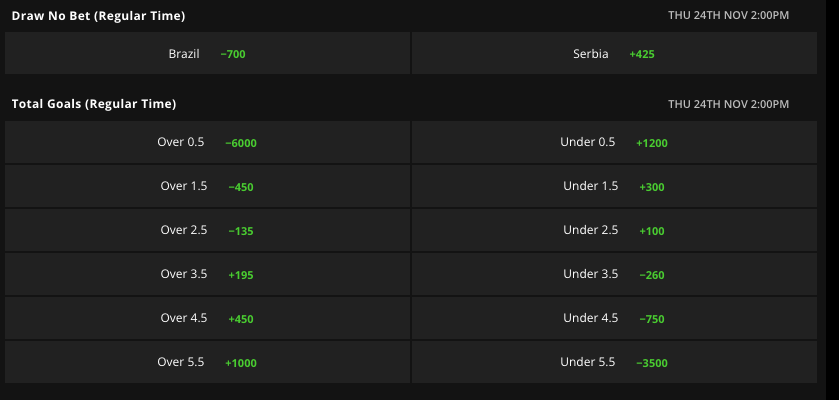

Soccer totals can be described as odds on the number of goals that a team will score in a given game. Predicting the total in soccer is difficult because it is one of the most low-scoring sports in the world. The high risk of soccer betting going wrong is another reason. 2.5 is the common soccer total. For a team to win, they must score more goals than 2. Alternately, a team can score three or more goals to win a match.

There are several ways to make money betting on totals. You can place your bet on either the Over or Under total score. This is often the best option for novices, since it is easier to predict the total score. Another option is to bet on props for each player. For example, if you think that Manchester and Barcelona will score a goal each, you can place a bet on how many goals each player will score in a half.

Handicap bet

Handicap soccer betting allows you to place bets on soccer matches. The handicap for a game is determined by the current form of each team. A team that has not done well in the past should not have their handicap calculated. The popularity of handicap soccer betting is growing. Also, handicap betting is possible in a Parlay. A parlay is a bet that covers more than one selection.

Handicap soccer betting can help make a one-sided match more exciting. The number of goals a team has scored in their 20 previous matches determines the numerical advantage they have over their opponent. The stronger team will have a greater negative handicap and must win more than what they were deducted at the start. Conversely, a team that has a higher handicap must lose less than they started the game with.

3-Way moneyline betting

Spread betting with soccer involves using the three way moneyline. This option allows for you to place wagers on either the win or draw of the match. However, you must be careful to make the right selection, or you may end up losing money! Before you place your bets on a soccer match, there are some things you should remember.

There are three possible outcomes for soccer spread betting. In the first place, the three-way money line is usually close to even money. This option is usually offered by the bookmakers at a modest margin. Aside from deciding whether a team is going to win, it is also important that you decide by the end if regulation has expired. If the score is 0-0 at the end of regulation, the game will be considered a draw.

Futures betting

Futures betting on soccer might be a good option if you like the thrill of betting on sports. Futures are wagers placed on soccer teams and games. This means that you can place bets at any stage of the season. However, odds will change throughout the season. Futures betting in soccer spread is more complex that betting on individual fixtures. To determine the best bet, you'll need to consider several factors.

When making a futures bet, you should look for the best times to place a wager. You should usually place a bet when the competition begins. But there are exceptions. For example, the FIFA World Cup is held every four years, so bookmakers will take futures wagers on the winner of the tournament as early as two years prior. This allows for you to benefit from early value.

FAQ

What is the best way for a side business to make money?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

Helping other people solve their problems is the best way for a person to earn a good reputation. Consider how you can bring value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

You will see two main side hustles if you pay attention. The first type is selling products and services directly, while the second involves offering consulting services.

Each approach has pros and cons. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. These gigs are also highly competitive.

Consulting is a great way to expand your business, without worrying about shipping or providing services. However, it takes time to become an expert on your subject.

To be successful in either field, you must know how to identify the right customers. This requires a little bit of trial and error. But it will pay off big in the long term.

Why is personal finance so important?

A key skill to any success is personal financial management. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why should we save money when there are better things? What is the best thing to do with our time and energy?

Yes, and no. Yes, as most people feel guilty about saving their money. Yes, but the more you make, the more you can invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

Controlling your emotions is key to financial success. You won't be able to see the positive aspects of your situation and will have no support from others.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you aren't able to manage your finances effectively.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will save you money and help you pay for your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

How can rich people earn passive income?

There are two methods to make money online. Another way is to make great products (or service) that people love. This is known as "earning" money.

The second way is to find a way to provide value to others without spending time creating products. This is "passive" income.

Let's say that you own an app business. Your job is to create apps. But instead of selling the apps to users directly, you decide that they should be given away for free. That's a great business model because now you don't depend on paying users. Instead, your advertising revenue will be your main source.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how internet entrepreneurs who are successful today make their money. Instead of making things, they focus on creating value for others.

What is the difference in passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income requires work and effort.

You create value for another person and earn active income. It is when someone buys a product or service you have created. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income allows you to be more productive while making money. But most people aren't interested in working for themselves. So they choose to invest time and energy into earning passive income.

The problem is that passive income doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. So it's best to start now. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types or passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Which side hustles are most lucrative?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types side hustles: active and passive. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Side hustles that are active include tutoring, dog walking, and selling products on eBay.

Side hustles that work for you are easy to manage and make sense. A fitness business is a great option if you enjoy working out. Consider becoming a freelance landscaper, if you like spending time outdoors.

You can find side hustles anywhere. Side hustles can be found anywhere.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you are a skilled writer, why not open your own graphic design studio?

Be sure to research thoroughly before you start any side hustle. You'll be ready to grab the opportunity when it presents itself.

Side hustles don't have to be about making money. Side hustles are about creating wealth and freedom.

And with so many ways to earn money today, there's no excuse to start one!

What is personal finance?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You won't have to worry about paying rent, utilities or other bills each month.

It's not enough to learn how money management can help you make more money. You'll be happier all around. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

So, who cares about personal financial matters? Everyone does! The most searched topic on the Internet is personal finance. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People now use smartphones to track their money, compare prices and create wealth. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. There are only two hours each day that can be used to do all the important things.

If you are able to master personal finance, you will be able make the most of it.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How To Make Money Online

Making money online is very different today from 10 years ago. How you invest your funds is changing as well. While there are many methods to generate passive income, most require significant upfront investment. Some methods are easier than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out what type of investor are you. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. You might also consider affiliate marketing opportunities if your goal is to make long-term money.

-

Do your research. Do your research before you sign up for any program. Review, testimonials and past performance records are all good places to start. You don't want your time or energy wasted only to discover that the product doesn’t work.

-

Start small. Do not jump into a large project. Start small and build something first. This will let you gain experience and help you determine if this type of business suits you. Once you feel confident enough, try expanding your efforts to bigger projects.

-

Get started now! It's never too late to start making money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All you need to get started is an idea and some hard work. Get started today and get involved!